Feel financially confident about your future.

Given current economic conditions there seems no better time to start planning financially for your future after work. Over the years you’ll have started building the basics for retirement. Now it’s time to pull all your assets, finances and retirement dreams into one place, mapping your route through retirement to make sure your money works for you.

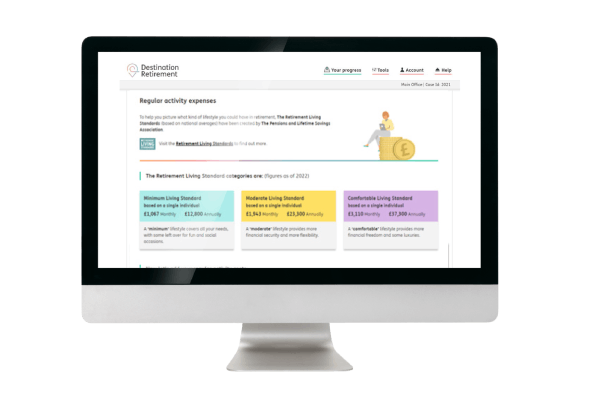

Use Destination Retirement, a free, interactive, online service, suitable for those age 55+, to receive a personal, tailored retirement plan free of charge. It will help you make the most of every penny of your savings, while ensuring you avoid the pitfalls, like paying too much tax, that could spoil your retirement.

Or for those age 45+, Pension Buddy will help you learn the essentials of planning for your retirement by asking a series of simple questions.

Available to Royal Mail Defined Contribution Plan members since 2022, these free to use services are provided by the organisation we have partnered with, HUB Financial Solutions.

“My experience of Destination Retirement is only positive. I felt prepared for all of the stages. You walked me through it very well. I never felt out of control, and it was very straightforward, it flowed easily, and I knew what I had to do.”

Simon

Get excited about your life after work and register for Destination Retirement today

Go to the ‘Taking money out of your pension pot’ https://rmdcp.uk/taking-money-out/who-can-help-you-decide-how-to-take-your-money section of the website where you will find all of the information.

Register and follow these simple steps.

Register your contact details with HUB Financial Solutions, the providers of Destination Retirement, and they will let you know when the next series of webinars will be taking place. The webinars will cover what Destination Retirement is, how it works and what the benefits are of using it.